Evolution of the 2021/22 Market Performance Operating Plan

The MPOP for 2021/22 will build on the lessons learnt and progress made from delivering the MPOP for 2020/21, alongside the findings from this year's AMPR. The following are initial considerations that will be used in the development of a MPOP 2021/22. We will consult on the draft plan before finalising and publishing in June 2021.

The MPOP will focus on improving trading party performance using the existing tools and incentives within the MPF. These tools include:

Performance charges

Charges incurred by wholesalers and retailers for failing to meet defined performance standards

Reputational incentives

The publication of peer comparison data based showing trading party performance against the MPS, OPS, and any Additional Performance Indicators (APIs) defined by MOSL

MOSL performance reporting

Assurance that MOSL is meeting its obligations as the market operator

Performance rectification and intervention

Resolution of performance issues to ensure that any trading party with sub-optimal performance takes appropriate remedial action, including the use of Initial Performance Rectification Plans (IPRPs) and Performance Rectification Plans (PRPs)

Guidance

Performance guidance provided by MOSL to facilitate improved performance.

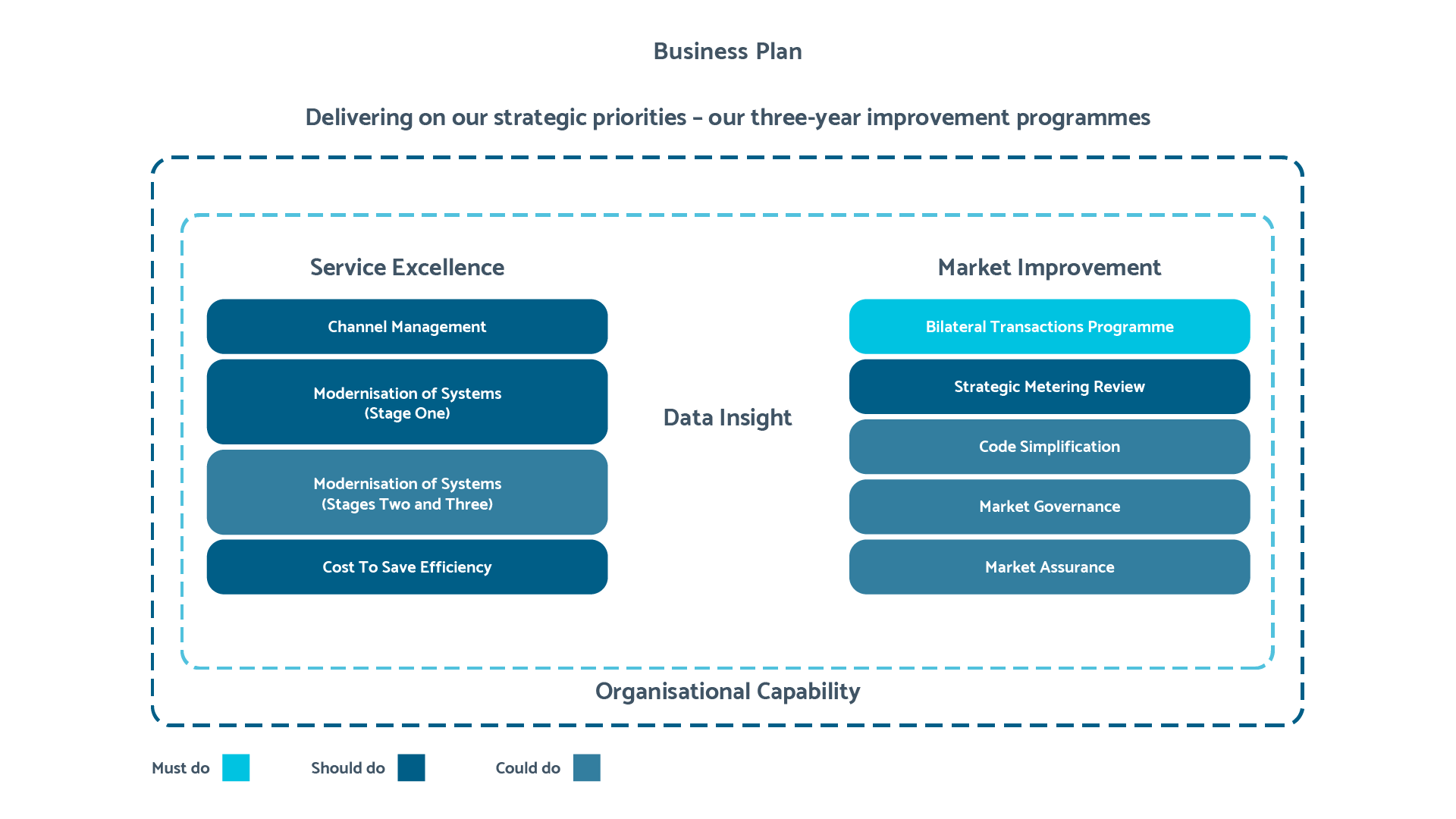

The MPOP will continue to apply, monitor and charge against MPS and OPS in accordance with the market codes. It will use these tools and levers to address key areas of risk and support the associated Improvement Programmes outlined in MOSL’s three-year Business Plan. This may include using Addition Performance Indicators (APIs) to monitor and incentivise performance, guidance documents and/or other intervention.

The performance areas which MPOP 2021/22 will focus on include:

Data quality

The MPOP will support core market data quality by monitoring performance against the measures outlined in the Core Market Data Improvement Plan, including - but not limited to - the completeness of Unique Property Reference Number (UPRN) and Valuation Office Agency (VOA) Billing Authority Reference Number, APIs and issues with Geographical Information System (GIS) Coordinates

Metering issues

The MPOP will support the Strategic Metering Review by monitoring performance against metering issues, such as the level of long unread meters

Vacancy

The MPOP will support efforts to reduce the level of vacancy in the market by monitoring performance against vacancy issues, such as vacancy with consumption and vacancy arising from newly registered supply points

Accuracy of estimation in settlement

The MPOP will support better use of YVEs within settlement by monitoring of YVE performance and percent of actuals at R1-RF. A more detailed explanation of the importance of these elements is contained in Section 3 - Market Consumption

Switching activity

The MPOP will provide for monitoring in relation to switching activity as the market emerges from COVID-19.

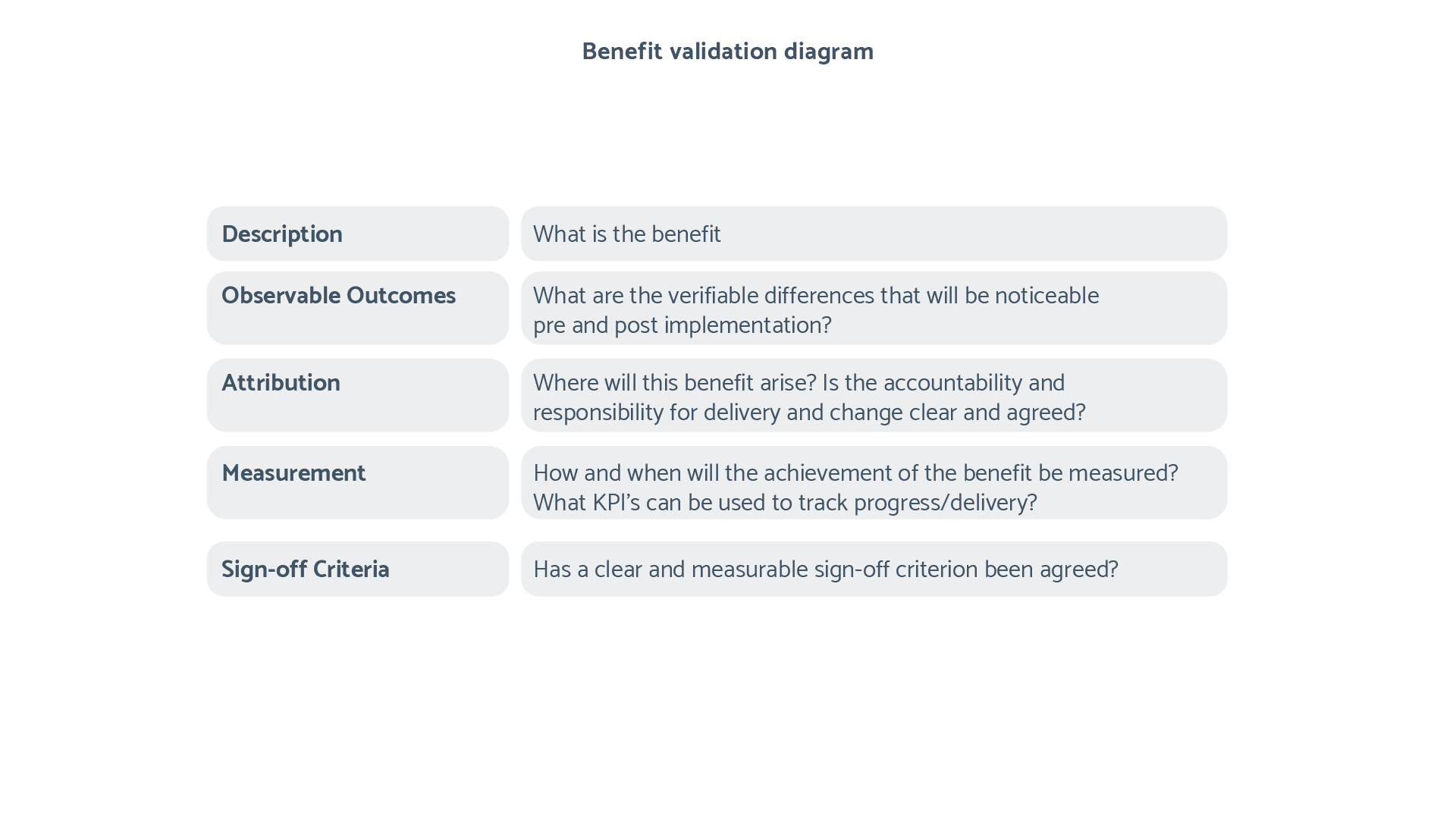

The content of the MPOP will be subject to the MOSL Benefit Validation Framework to ensure activities are directly aligned to the Business Plan. These principles will ensure a more streamlined MPOP and will promote the direct applications of the tools, and levers of the Market Performance Framework (MPF) to improve trading party performance. This will support the development and implementation of tactical improvements needed for the MPF to respond to changes in performance, environmental and societal impacts and evolving challenges arising from the medium and long term impacts of the pandemic.